Informing investment in climate solutions

We advise investors, banks, and grantmakers on allocating capital towards solutions that build resilience and improve energy access

Powered by our Risk Analytics Engine, Nithio helps you understand critical components of climate solutions, including assessing household-level credit risk, directing capital type based on need, and improving the sustainability of asset financing.

Our analytics can be applied to solar, carbon, clean cooking, e-mobility, residential solar, and additional climate and energy solutions.

Climate Solutions services, powered by Nithio’s Risk Analytics Engine, help you:

Structure Facilities & Programs

Deploy capital with Nithio’s risk-informed analytics

Nithio’s combined lending and analytics expertise informs how best to finance climate solutions.

Assess Risk & Conduct Due Diligence

Forecast customer payments to determine credit risk

Nithio’s AI models predict a customer’s likelihood to repay and cash flows.

Ensure Investment Sustainability

Monitor investment health and track impact in real time

Nithio provides seamless updates on portfolio and impact progress.

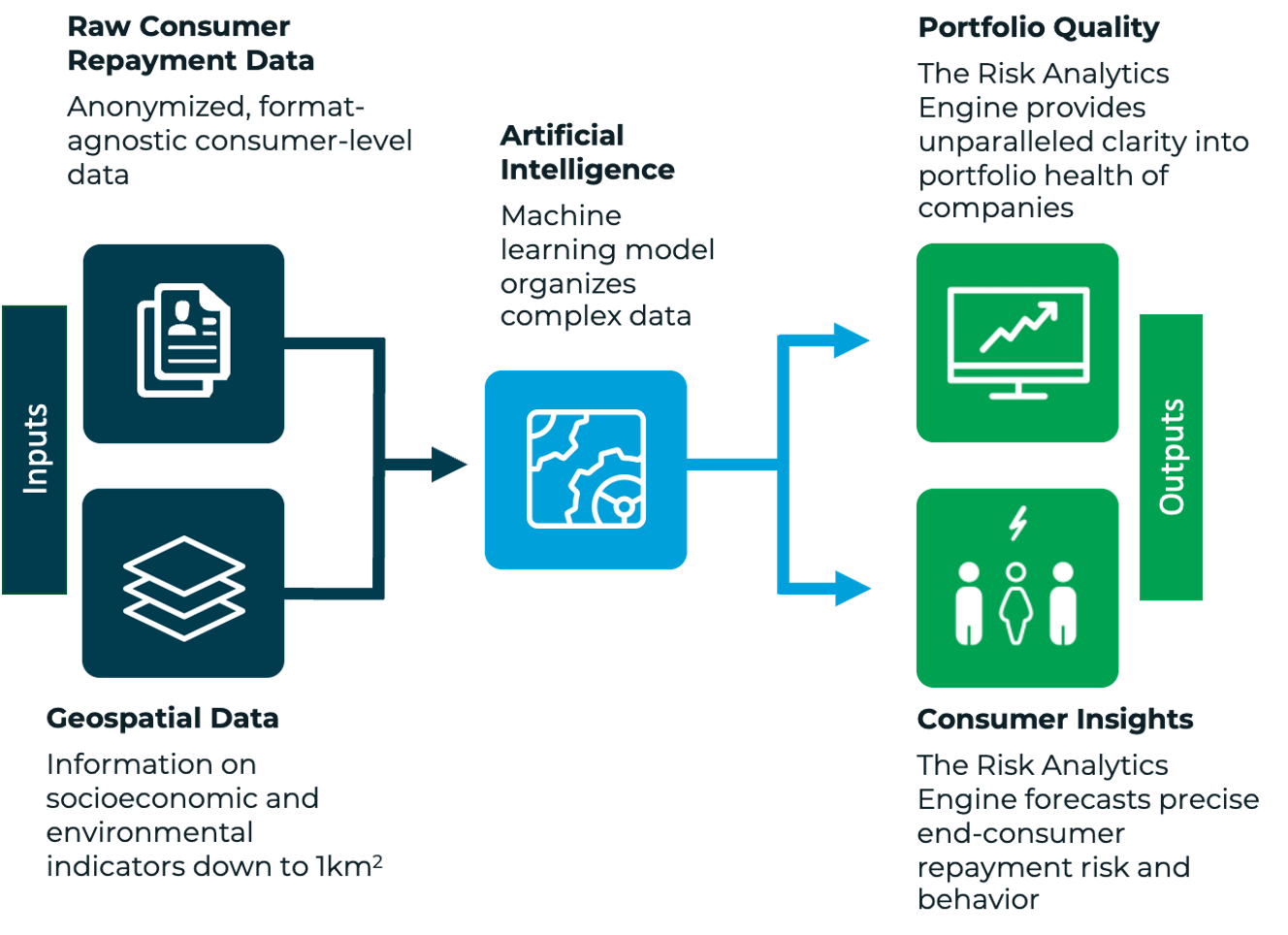

Risk Analytics Engine: How it works

Nithio’s innovative approach looks forward. Previously, the industry was forced to rely only on historical data analysis. Our Risk Analytics Engine predicts customer characteristics from the point of origination and accurately forecasts repayment rates and future cash flows of companies with an accuracy that outperforms estimations drawn from historical time series data.

To accomplish this, Nithio combines localized geospatial socioeconomic and demographic data down to 1 sq. km with anonymized customer repayment data. Together, these sources serve to train Nithio’s Artificial Intelligence (AI) models. Read more here.