What happens when solar home system or solar productive use distributors fail? It’s a tough, low-margin business and some failures are unfortunately inevitable, but customers shouldn’t be left without power and their payments on the systems continue to hold value.

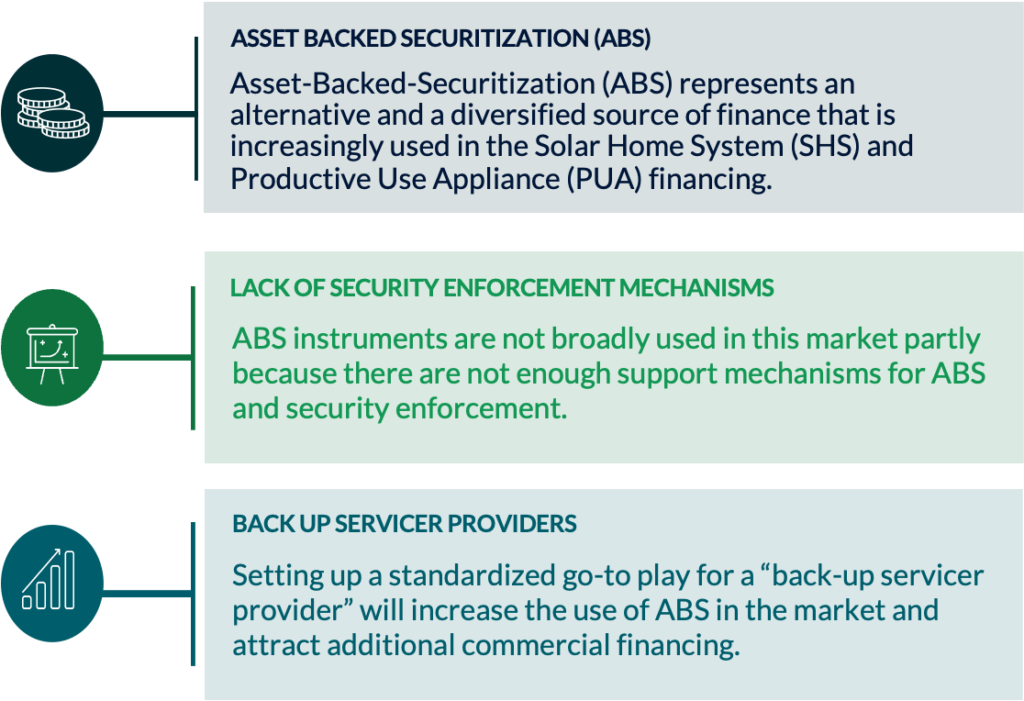

Providing a back-up servicer ensures continuity of service and access to clean energy for the company’s hundreds or thousands of customers. It also unlocks the potential for off-balance sheet receivables financing. Nithio, leveraging its AI-enabled financing platform, wants to create an industry standard to meet this need and enable sustainable growth of the sector.

A back-up servicer is able to mitigate the default risk incurred by investors in an Asset-Backed-Securitization (ABS) to ensure continuity by valuing and taking over the servicing of the portfolio of receivables in case the Asset Originator / Operating Company (OpCo) fails. A back-up servicer helps to ensure that customers continue to have access to energy products that improve livelihoods and build climate resilience and provides the sector with a safety net – making investors more comfortable in the sector.

What is needed to set up a back-up servicer provider:

- Legal Agreement: Setting up a standardized legal agreement that will be part of the initial finance documents package, which details the implementation of the back-up servicer if the OpCo fails.

- Back-up Operating Company: The back-up servicer takes over the servicing of the portfolio in case the OpCo fails. The servicing of the portfolio can be performed either:

- Via the process of tendering the role as servicer to a competitor in the SHS and PUA sector (or affiliated sectors like MFIs) or

- Via the “pre-hire” of existing staff, as well as servicing agreements, spare parts, warehousing, etc. arranged via a ”living will” with the original OpCo.

- Data Platform: Ability to assess and monitor the performance of OpCo portfolio and forecast the real value of its outstanding receivables and cash flows. The platform needs to analyze raw customer repayment data and not what has been reported by the company.

Nithio’s SOLAR (“Servicer Of Last Resort”) Solution: Nithio will leverage its Risk Analytics Engine for the back-up service financing, using its analytics to value the existing receivables of a portfolio and ensure an accurate forecast of the real value of outstanding receivables. This ensures that the receivables can continue to be serviced sustainably, energy customers do not lose access to their products, and investors are repaid.

Nithio’s Engine provides critical insights on portfolio quality and consumer behavior, including segmentation of customers by risk, forecast of customers’ repayment trajectories, and prediction of cash flows. This capacity is used to calculate the real value vs. the face value (contracted) of a ring-fenced receivables portfolio on a discounted basis. To do so, Nithio’s platform plugs directly into the CRM systems of OpCos to onboard raw, anonymized customer repayment data, which is then combined with a rich database of geospatial socioeconomic, demographic, and climate data. Together, these serve as the training datasets to Nithio’s AI models.

If the operating company fails, Nithio can leverage its Risk Analytics Engine to implement either of the below two strategies:

- Provide an accurate forecast of the real value of the outstanding receivables: When the portfolio is transferred to the back-up servicer, Nithio will be able to determine the expected repayment schemes and can be a neutral guide/facilitator of negotiations between creditors, back-up servicer, and operating company.

- Taking over and monitoring creditors on behalf of the operating company and existing (debt)-investors: Nithio, together with a Back-up Servicer Operator, can help to buy/bail out the portfolio from existing investors in the structure because it has access to the real value of the outstanding receivables and can therefore raise financing for it.

No one wants to see impact-driven businesses fail, but the reality is that most solar home system distributors are early-stage companies operating in a challenging environment and some failures are inevitable. Investors in the space are motivated not just to secure their investments, but to ensure households are not forced to take a step back if their energy provider goes out of business. Nithio’s data analytics can show the value of these receivables and play a central role in sustainably scaling the off-grid solar market.

Recent Comments